The Internal Revenue Service (IRS) states that many cryptocurrencies can be converted to virtual currencies. This means they act as a medium of exchange, a unit of account, and a store of value that can be replaced for real money. This also implies that any profits or income from your crypto are subject to tax. However, you have to consider a lot regarding crypto tax, how it is taxed, and whether you owe tax or not, which depends on specific circumstances. In this article, I will walk you through the best crypto tax software, crypto tax rate, calculator and form.

Key Points

- Crypto taxes apply when you sell, trade, or use cryptocurrency, but simply holding it isn’t taxable unless earned through mining or staking.

- Tax rules and forms vary by location, so keeping accurate records of transactions is essential to simplify reporting.

- Crypto tax software like CoinLedger, CoinTracker, Koinly, and TokenTax makes tax season easier by automating transaction tracking and generating the necessary forms.

- These tools offer features like tax-loss harvesting, portfolio tracking, and error correction, supporting multiple cryptocurrencies, exchanges, and DeFi platforms.

- Crypto is taxed as ordinary income or capital gains, with rates depending on how long you’ve held the asset and the nature of the transaction.

Crypto Tax

Crypto tax can seem like a complicated puzzle, but it’s basically how the government wants a piece of your profits or income from cryptocurrency. Whenever you sell, trade, or even use crypto to buy something, you could owe taxes just like you would with stocks or property.

For example, when you bought some Bitcoin when it was cheap, and when it’s worth a lot more you sell it, the government sees that profit as taxable income. The same goes if you trade your Bitcoin for Ethereum, or use it to buy a new laptop. So if you’re earning crypto through mining or staking, that’s also taxable income.

However, it’s not always straightforward. You might not owe anything if you just hold onto your crypto without selling or using it. Also, the rules can differ depending on where you live, making the whole thing feel even more overwhelming. I have provided a checklist below to help you navigate the tax season more smoothly.

Crypto Tax Checklist

Read Also: Top 10 Crypto Trading Mistakes to Avoid for Beginners (2024 Guide)

Best Crypto Tax Software

When it comes to crypto taxes, they can be stressful and overwhelming without crypto tax software. I remember my first tax season after trading different cryptocurrencies for months. I was overwhelmed and worried about the transactions I needed to report, trying not to forget anything important.

In that difficult situation, I learned the best crypto tax software, which changed everything. These crypto tax softwares guided me through easy questions and reviewed my transaction history. This made it very easy to see what I needed to pay.

Crypto tax softwares helped me find ways to use capital loss deductions when I suffered losses in my trading. I was relieved to know that I could save money. Furthermore, I have shared below the best crypto tax software options that can make tax season easier for you, too.

#1. CoinLedger

CoinLedger is a user-friendly crypto tax software that simplifies managing your cryptocurrency taxes. It is less complicated than other crypto tax software because it allows you to complete your crypto taxes within minutes. The software supports integrations and connects with over 350 exchanges, 181 DeFi platforms, and nine wallets, including MetaMask, Trust Wallet, and Exodus. You can track your gains and losses easily throughout the year, even if you are dealing with complex things like swaps or using DeFi platforms like Aave, Uniswap, Compound, or Pancake. This tool makes importing all your trades less difficult, whether you are dealing with cryptocurrencies or NFT.

Key Features:

- Easy Tracking: It monitors your gains effortlessly and losses throughout the year.

- Wide Integrations: CoinLedger connects with over 350 exchanges and 181 DeFi

- Streamlined Trade Importing: This crypto tax software import trades for cryptocurrencies and NFTs with ease.

- Built-in Calculators: This helps determine your tax liability accurately.

- Automated Tax Forms: It generates all necessary tax forms and reports for filing.

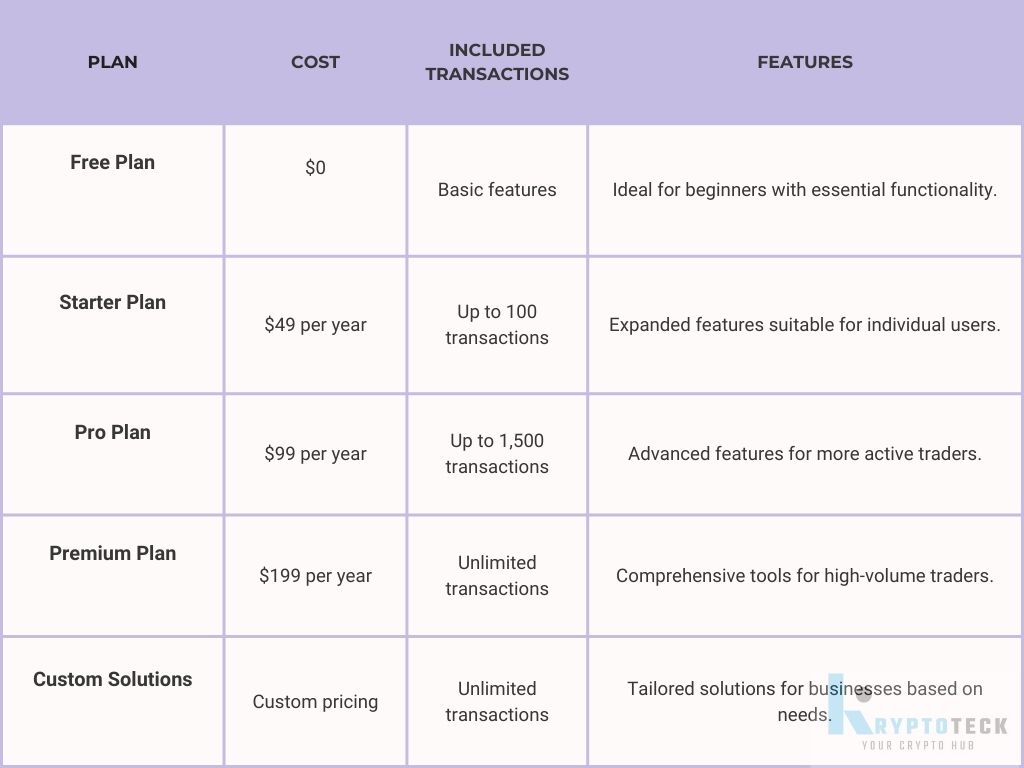

Pricing

#2. CoinTracker

You cannot discuss the best crypto tax software without mentioning the CoinTracker tool. This software stands out as one of the best and most trusted, with over a million users relying on it to stay compliant with tax regulations. It provides cost optimization and automated portfolio tracking methods that ensure that crypto tax management is more accurate and accessible.

When I started trading in cryptocurrency, it was a huge headache, especially when the tax session rolled around. It was then that a fellow crypto enthusiast recommended CoinTracker. At first, I was reluctant because there are many tools out there, but after linking my wallet and exchanges, I felt a big relief because this software helped me track every transaction I made and even categorized them for tax purposes.

So, I recommend this software if you are like me and you manage multiple wallets and exchanges. Syncing them all through CoinTracker can save you hours of manual input. Additionally, its cost optimization features will help you avoid paying more taxes than required.

Key Features

- Official tax partner of top platforms like Coinbase, OpenSea, TurboTax, and H&R Block

- Automated portfolio tracking that supports 500+ exchanges and 10,000+ cryptocurrencies

- Tailored tax support for countries like Australia, Canada, India, the USA, and the UK

- The mobile app syncs your holdings effortlessly with exchanges and crypto wallets

- For users with over 1,000 transactions, custom pricing plans are required

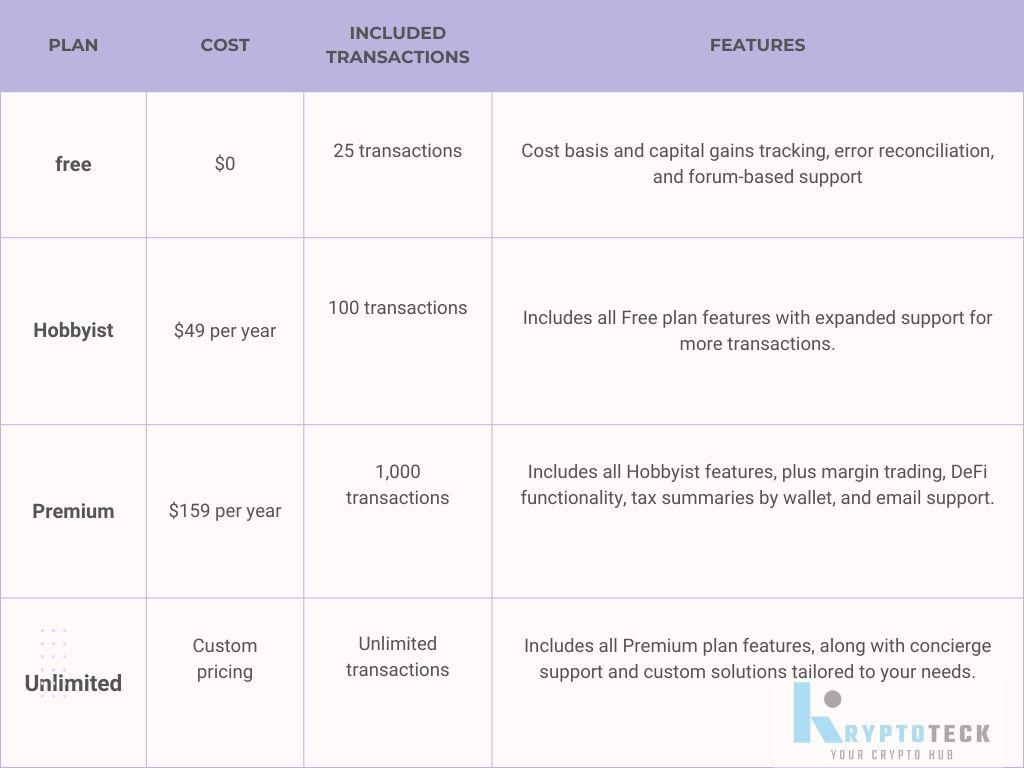

Pricing

#3. Koinly

This is one of the best crypto tax software that offers a simple and easy-to-use interface with powerful features that make it suitable for beginners. I have been managing my crypto assets for some time now, and Koinly is another software that can help you go through tax season easily. It has an easy setup where you can connect your exchanges and wallets, and it has helped me some time ago import all my trade and transfer, saving me hours of manual work. The smart tax reports and accuracy will help remove the stress of filling, so make it your go-to tool.

Additionally, its simple and powerful features make it ideal for anyone, whether beginners or seasoned traders. Its tiered pricing gives you options for every budget.

Key Features

- Supports 17,000+ cryptocurrencies

- Compatible with 400+ exchanges and wallets

- Available in over 20 countries

- Generates international tax reports

- Tracks your portfolio

- Smart transfer matching to avoid taxing transfers between your own wallets

- Supports margin and futures trading

- Income tracking for mining, staking, lending, etc.

- Tools to fix errors and ensure accurate tax reports

- Free trial with no time limits

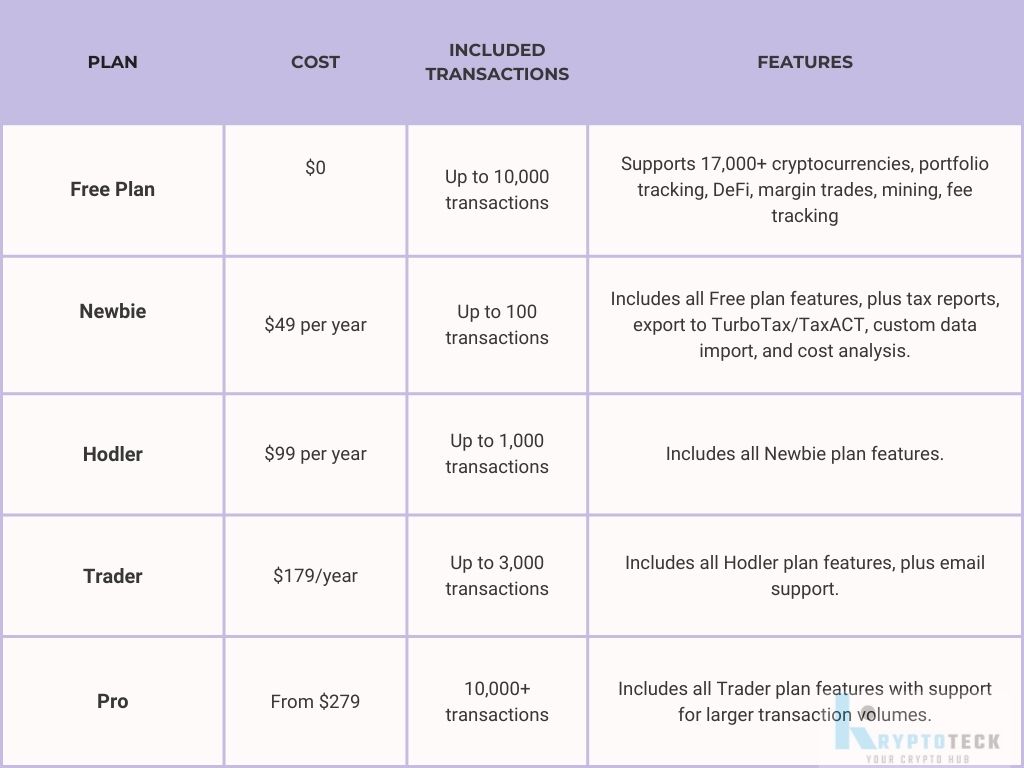

Pricing

#4. TokenTax

When you talk about TokenTax as one of the best crypto tax software, it centers on its ability to connect effortlessly with different exchanges, protocols, and wallets, making it easier to manage your crypto taxes. Furthermore, it has a tax loss harvesting feature and generates tax forms automatically. This helps to simplify the process, minimise your tax liability, and file with ease.

In addition, TokenTax’s access to dedicated crypto accounting experts and reconciliation teams makes it one of the best. They provide deep knowledge in crypto, DeFi, and NFTs to ensure you are fully supported throughout the process.

Key Features

- Tracks your portfolio

- API and wallet integrations

- Supports DeFi and NFTs

- Margin and futures trading support

- Tax loss harvesting dashboard

- Reports for mining and staking income

- Automatically generates tax forms

- Expert human guidance

- Full filing services are available

- Identifies and corrects errors or missing data

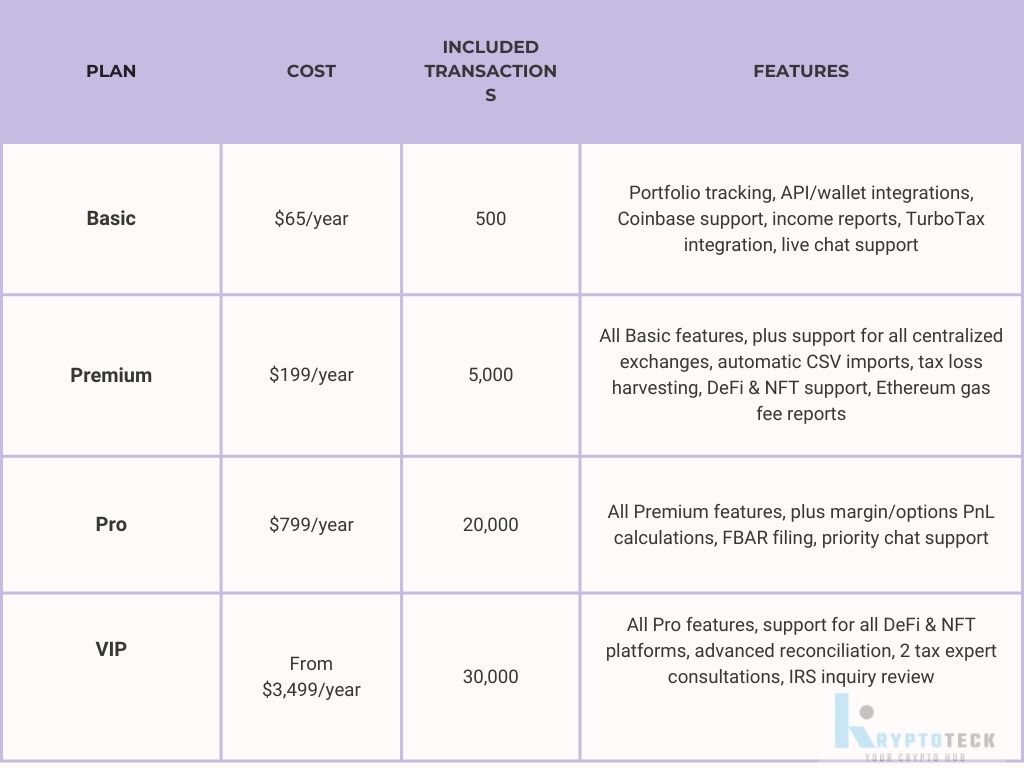

Pricing

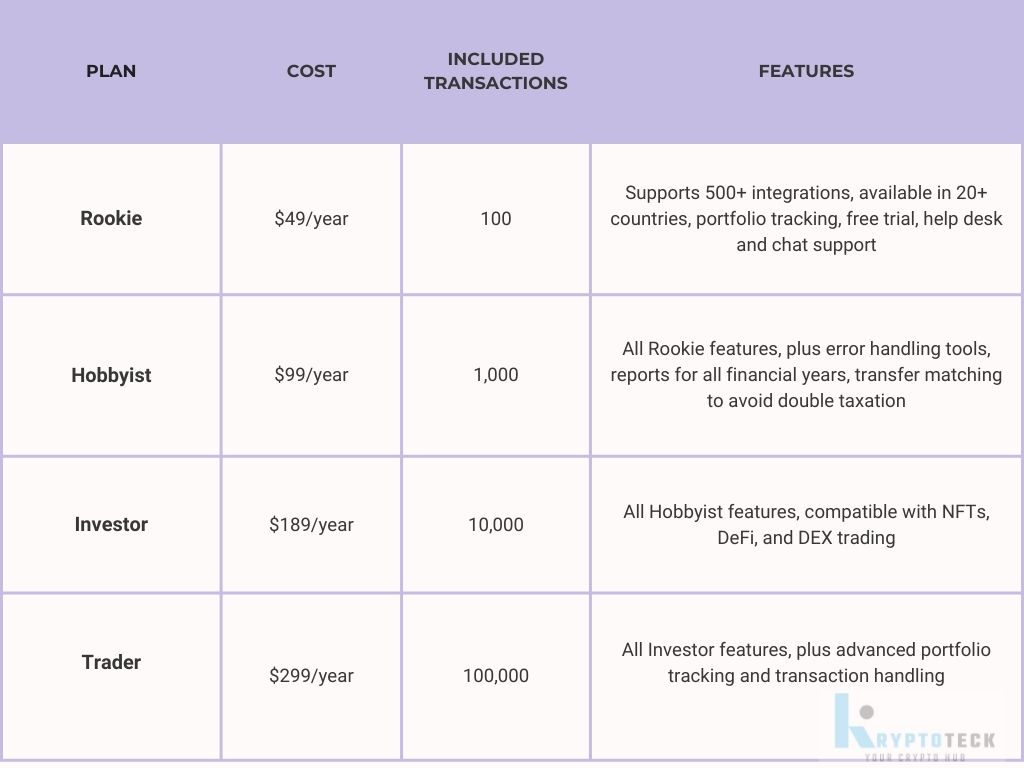

#5. Crypto Tax Calculator

For those needing affordable solutions for handling your crypto taxes, the Crypto Tax Calculator is an appropriate option; each plan has unlimited integrations, smart features and many tax reports. You only need to pick anyone that matches the number of transactions you need. Moreover, it has a 30-day free trial and a 30-day money guarantee to test it out.

Some time ago, after using various tools, but felt costly and rigid. I stumbled on the Crypto Tax Calculator and was impressed by how easily it connects everything. I set it up and watched as it imported all my trades without a hitch. The transfer matching feature was beneficial and ensured I wasn’t taxed on my internal wallet transfer. My experience with this software gave me peace of mind as I didn’t break the bank, and I also appreciated the 30-day money-back guarantee. Here is a step by step video to enable you to understand better.

Key Features

- Supports 500+ integrations

- Available in over 20 countries

- Tracks your portfolio

- Compatible with NFTs, DeFi, and DEX trading

- Provides reports for all financial years

- Transfer matching algorithm to avoid double taxation

- Error handling tools

- Help desk and chat support

- Free trial

Pricing

Read Also: How to Make Money in Crypto: Expert Tips and Strategies for Success

Crypto Tax Form

A crypto tax form is what you’ll need when it’s time to tell tax authorities like the IRS in the U.S. or HMRC in the UK about your cryptocurrency transactions. Like stocks or real estate, crypto is treated as property for tax purposes. This means that whenever you buy, sell, or trade crypto, you must report any money you make or lose from those transactions.

But don’t worry, it’s not as tricky as it sounds. For example, let’s say you bought Bitcoin for $20,000 and sold it for $30,000. The $10,000 you made is something you’ll need to declare on your taxes.

On the flip side, if you sold it for $15,000, that’s a loss you can report, which can help lower your tax bill.

Why does it matter? The taxman wants a cut of your gains, but here’s the silver lining: losses can sometimes work in your favour by lowering your overall tax bill. So, you must keep good records, as this will make tax season a lot easier and could even save you some money.

It does not matter if you’ve been trading crypto for years or just started with Bitcoin or Ethereum; reporting your transactions is part of the deal. Always remember that the trick is staying organized and keeping track of everything. And remember you’re not alone. Millions of crypto holders are doing the same thing, so you’ve got company.

Types of Crypto Tax Form

The following are the types of crypto tax forms you may come across and how they apply to your situation.

Tax Forms Sent to You:

#1. Form 1099 (K or B)

This type of crypto tax form depends on how active you are in the crypto world and which exchange you’re using. If you’re buying, selling, or trading crypto, your exchange will send you either Form 1099-K or Form 1099-B to report your transactions. The 1099-B usually shows your capital gains or losses, while the 1099-K gives an overview of your transactions, especially if you’ve moved a significant amount of crypto.

When I get a 1099-K, I realize it doesn’t provide all the details I need. For instance, it usually doesn’t show my cost basis—the amount I originally paid for my crypto. I’ve learned that with a 1099-K, I need to pull from my records to figure out my gains or losses accurately. It may feel like extra work, but staying prepared and organized with your transaction history makes the process much more manageable.

#2. Form 1099-NEC

If you’re working as an independent contractor or freelancer and receive payment in crypto for your services, you’ll probably get Form 1099-NEC. This crypto tax form is specifically for reporting income earned from your work, and yes, that includes any payments you get in cryptocurrency.

Even if you’re paid in Bitcoin or another crypto, the IRS treats it as income, just like cash. For instance, if you were paid 1 ETH valued at $2,500, you must report $2,500 as income on your tax return.

#3. Form W-2

If your employer pays you in cryptocurrency instead of regular money, you’ll get a W-2 just like if you were paid in dollars. Your employer will report the fair market value of the crypto you were paid on the day you received it.

Imagine getting paid in crypto from a forward-thinking employer while it’s exciting, you’ll have to keep track of the value when you receive it to ensure you’re reporting your wages correctly on your taxes.

Tax Forms You Need to Complete:

#1. Form 8949 (Capital Gains and Losses)

You’ll need to fill out Form 8949 if you’ve sold or traded any cryptocurrency, as this is where you report your capital gains or losses. The trick here is to ensure you enter the correct numbers, especially if you received a Form 1099-B from your exchange, which often includes a summary of your transactions.

If you get a 1099-K, you must take a more hands-on approach. That’s because this form doesn’t always show your cost basis the original value of your crypto. So, you’ll have to dig up that information yourself. This step is vital for accurately calculating your gains or losses when filling out Form 8949.

#2. Form 1040 (Individual Income Tax Return)

Everyone’s favourite tax form! If you’ve had any capital gains or losses, you’ll transfer those totals from Form 8949 onto your Form 1040 (specifically on Schedule D). But that’s not all:

- If you’ve earned wages in crypto (your employer pays you in Bitcoin), you’ll report that amount as wages.

- If you were paid in crypto for freelance work or services, you’ll report this income either as other income on Schedule 1 or as self-employment income on Schedule C.

So, think of this as a puzzle where all the pieces fit together Form 8949 handles your trades, Form 1040 handles your overall tax situation, and everything feeds into one place for the IRS to get the complete picture of your crypto activity.

Lastly, on your Form 1040, there’s a small but important checkbox that asks: “At any time during the year, did you receive, sell, send, exchange, or otherwise acquire any financial interest in virtual currency?”

You’ll need to answer “yes” or “no” to this question, so don’t overlook it! Even if all you did was receive some crypto, you have to declare it.

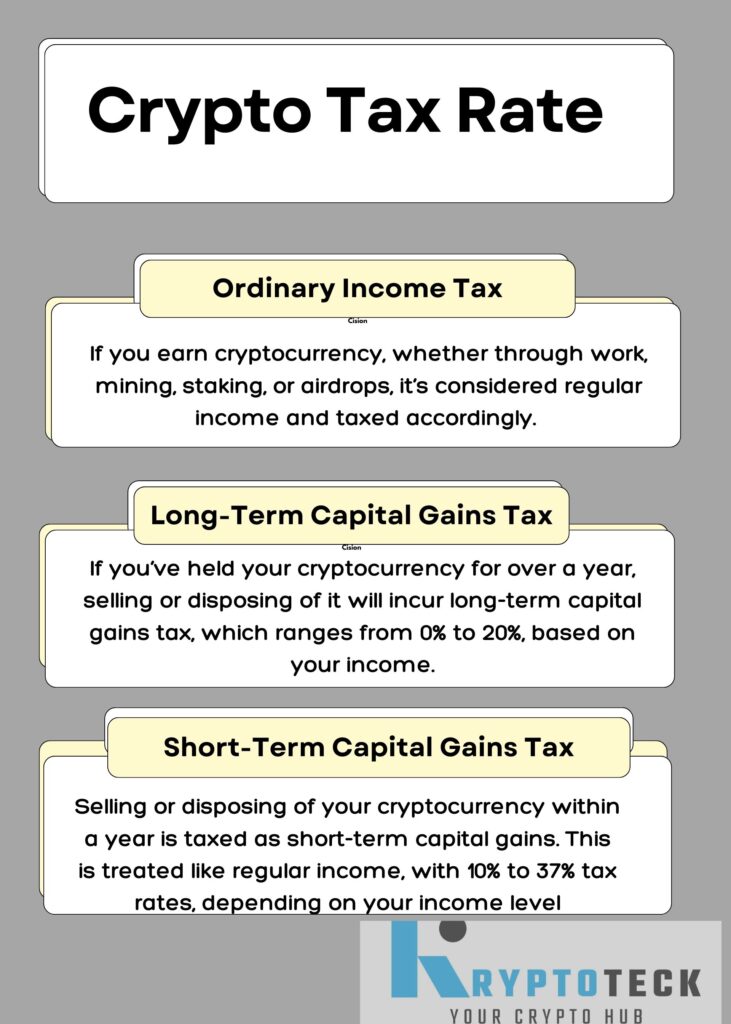

Crypto Tax Rate

When you hear crypto tax rate, it simply refers to the percentage at which your cryptocurrency transactions or earnings are taxed. This can vary based on how you acquired the crypto and how long you’ve held it. Your cryptocurrency could be taxed as long-term capital gains, short-term capital gains, or regular income, depending on your situation.

#1. Ordinary Income Tax

If you earn cryptocurrency, whether through work, mining, staking, or airdrops, it’s considered regular income and taxed accordingly. The crypto tax rate can vary from 10% to 37%, depending on your income. When you get rid of cryptocurrency, it’s taxed as a capital gain. This applies when you sell it, trade it for other cryptocurrencies, or use it for purchases.

#2. Long-Term Capital Gains Tax

If you’ve held your cryptocurrency for over a year, selling or disposing of it will incur long-term capital gains tax, which ranges from 0% to 20%, based on your income.

#3. Short-Term Capital Gains Tax

Selling or disposing of your cryptocurrency within a year is taxed as short-term capital gains. This is treated like regular income, with 10% to 37% tax rates, depending on your income level.

Conclusion

Handling crypto taxes might seem tricky at first, but it’s actually quite manageable if you stay organized. Whether you’re buying, selling, or earning crypto through mining, it’s important to keep track of your transactions. Additionally, tools like CoinLedger, CoinTracker, and Koinly can really help by making it easier to organize your data and get your taxes right.

So, if you start early and keep your records in order, tax season will be a lot less stressful. With the right tools, you’ll be ready to file your taxes smoothly without any unnecessary hassle.

How to Calculate Crypto Taxes?

In the United States, cryptocurrency tax rates vary depending on your income and the length of time you retain the assets. Short-term gains are taxed at regular income rates ranging from 10% to 37%, whereas long-term gains are taxed at preferential rates ranging from 0% to 20%, based on income. Income from cryptocurrency is taxed at conventional income tax rates.

How Much Tax Will I Pay on Crypto?

Your entire annual income determines the exact amount of Capital Gains Tax you owe from cryptocurrency trading. This figure affects how much your cryptocurrency profits are taxed at 10% or 20%.

How to Get a Tax Report for Crypto?

Fill out Form 8949 to document your cryptocurrency transactions. Transfer the totals from Form 8949 to Schedule D on your tax return. If you are self-employed, use Schedule C to report any ordinary income from bitcoin. Otherwise, use Schedule 1 of Form 1040.

Does the IRS Accept Bitcoin?

The IRS will accept it as evidence of fair market value. The value is determined by a cryptocurrency or blockchain explorer that scans global cryptocurrency indexes and estimates the cryptocurrency’s value at a specific date and time.