A 50% decrease in the block reward occurs usually every four years and is referred to as the “Bitcoin Halving.” If market conditions stay the same, this reduces the amount of bitcoins available for purchase, increasing their scarcity and perhaps driving up their price. Significant network effects result from the halving of Bitcoin. Because smaller companies and lone miners leave the mining ecosystem or are acquired by bigger organizations, miners may see a concentration of their ranks due to the halving event. In this article, I will be discussing in detail concerning Bitcoin halving, why it is halving, and its impact.

Key Points

- Bitcoin halving reduces miners’ rewards by half every four years to control the supply and prevent inflation.

- Miners earn rewards by solving puzzles to validate transactions, but these rewards are halved during each halving event.

- While Bitcoin halving doesn’t cause immediate price spikes, it has historically led to long-term price increases due to reduced supply.

- Investors debate whether to buy before or after halving, but long-term investment strategies typically yield positive results.

- The next Bitcoin halving is expected in April 2025, and many anticipate a potential rise in Bitcoin’s price, following past trends.

Overview

It took me longer than you might imagine to get familiar with Bitcoin. In 2015, one of my best friends, Mike, was the one who first introduced me to cryptocurrency. I had no idea what Bitcoin was at the time, much less how it worked with halving. On the other hand, Mike has years of experience mining and investing in Bitcoin. It took me some time to figure out why this “Bitcoin halving,” which he kept bringing up, was such a big deal.

The Bitcoin halving is, to put it simply, a planned occurrence that takes place around every four years and reduces by half the reward that miners earn for generating new blocks to the Bitcoin blockchain. The coding of Bitcoin incorporates this procedure to limit the amount of new coins that may be put into circulation, therefore preventing inflation. Miners received 50 BTC for each block they uploaded successfully to the blockchain when Bitcoin first launched in 2009. This award has since been cut in half several times.

Block rewards are a byproduct of the blockchain’s autonomous mining process, which opens new blocks and validates transactions. If miners—participants in a contest to solve a cryptographic puzzle—complete it first, they win fresh bitcoins. The network initiates a new race when their block is put to the blockchain and they are rewarded. In the hopes of earning a steadily declining reward, each miner verifies the information in the freshly added block while attempting to solve the problem for his or her new blocks.

For those new to Bitcoin or halving, I have provided below a step-by-step checklist that will guide you through the important steps to understand Bitcoin halving and prepare for its potential impacts.

Bitcoin Halving Checklist for Beginners

What Is the Process of Halving a Bitcoin?

The network’s core blockchain software incorporates a bitcoin halving that controls the frequency whereby new bitcoins are issued. To validate transactions, computers in the network must compete with one another (a technique called “mining”). The computers that successfully validate the activities they have chosen are rewarded with additional bitcoins. The network is programmed to cut the reward that miners earn every 210,000 blocks, with transactions being validated in groups known as “blocks.”

When they apply advanced math to add a set of entries to the Bitcoin blockchain in the course of its proof-of-work process first, they will now receive 3.125 BTC. 3.125 BTC is equivalent to around $200,000 at today’s bitcoin price. For miners, that provides a respectable incentive to continue adding blocks that ensure smooth Bitcoin transactions.

According to the Bitcoin code, the incentive for miners is halved once every 210,000 blocks are generated. Approximately every nine minutes, new transaction blocks are added. About every four years, during times when there is typically more volatility in the price of bitcoin, that occurs.

Also Read: What Is a Blockchain? : How It Works, Origin & Types

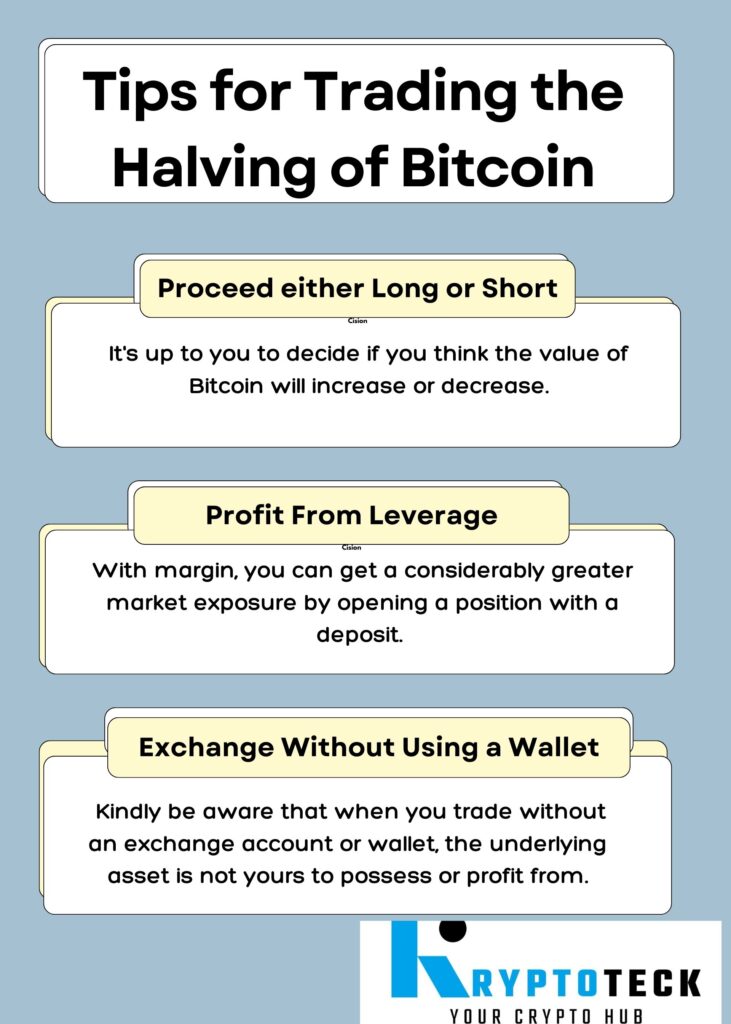

Tips for Trading the Halving of Bitcoin

One can trade the halving of bitcoin. Via exchanges, you can purchase the coins directly or bet on the price of the cryptocurrency by using derivatives like CFDs. Find out additional information on the operation of cryptocurrency trading. The following can be traded concerning the bitcoin halving:

- Study up on cryptocurrency CFD trading.

- Register or use a demo account to practice.

- Do a platform search for “bitcoin.”

- Get into the role you are in.

The fact that you do not become the owner of the core coins when you trade cryptocurrencies using derivatives like CFDs is one of its key advantages. Because of this, you can:

#1. Proceed either Long or Short

It’s up to you to decide if you think the value of Bitcoin will increase or decrease.

#2. Profit From Leverage

With margin, you can get a considerably greater market exposure by opening a position with a deposit. With leverage, you can invest a fairly low portion of your wealth and acquire significant exposure to the financial market. Leverage increases both the potential for gains and losses in this manner.

#3. Exchange Without Using a Wallet or Exchange Account

In only a few minutes, you might be prepared and ready to trade. Kindly be aware that when you trade without an exchange account or wallet, the underlying asset is not yours to possess or profit from.

When Was the Last Bitcoin Halving?

By 2020, I was becoming a little bit obsessed with the idea of Bitcoin halving. In the history of Bitcoin, there have been three halving events. The most recent one was on May 11, 2020. I had experimented with Bitcoin investing at that point, in addition to doing fundamental research. 6.25 Bitcoins instead of 12.5 Bitcoins was the mining reward. I had the opportunity to personally witness the joy of the community during this period.

Discussions in forums, social media, and even conventional financial news were lively in the weeks preceding the halving. What would happen to the price of Bitcoin following the halving was a topic of much speculation. Price hikes were notable in the past due to similar halvings that occurred in 2012 and 2016. Only more anticipation resulted from this.

Mike, who had already profited handsomely from the 2016 halving, and I had a conversation about the event. Speaking about the halving’s economic impact, he emphasized that, in theory, a decrease in supply will always lead to a rise in demand, which should drive up the worth of Bitcoin. A common issue among newbies was whether to purchase additional Bitcoin in the weeks preceding or following the event.

What Is Bitcoin’s Halving Impact?

Examining both the long- and short-term implications is necessary to fully comprehend the impact of the Bitcoin halving. My observations indicate that the immediate fallout from the 2020 halving was not as severe as some had thought. Though they didn’t suddenly soar, prices did vary somewhat. But as Mike had warned, it took some time for the halving’s true effects to become apparent.

The price of Bitcoin increased over the months that followed the halving, and by the end of the year, it had surpassed $20,000. The decreased supply is a factor in this. Because miners were receiving less Bitcoin for doing the same amount of work, a few new coins were being created, which led to a rise in the worth of the asset due to scarcity.

Miners suffered significant income losses as a result of the reduction. My friend, who had a small mining company, saw a reduction in profits following the halving. On the other hand, large-scale miners who operated more efficiently were able to remain competitive. Thus, the halving might be interpreted as a sort of organic “weeding out” of less skilled miners, retaining only the most skilled participants.

The halving of Bitcoin frequently indicates a change in attitude toward the wider market. Institutions, dealers, and investors start to pay closer attention, even though the precise economic ramifications take months to manifest. Following the 2020 halving, institutional investors started to accumulate significant amounts of Bitcoin, including Grayscale and MicroStrategy. A change in perspective was evident to me: institutional portfolios were starting to view Bitcoin as a significant asset, not just something for tech enthusiasts or individual traders.

Does Bitcoin Halving Increase Price?

According to my observations and experience, this is one of the most commonly asked questions about Bitcoin halving, and the solution isn’t simple. Bitcoin price hikes and halvings generally do not happen at once, despite this tendency. Bitcoin, for example, did not immediately soar in value upon the 2020 halving. Rather, a clear increasing trend did not emerge for some months.

All of Bitcoin’s price halvings throughout its history have, however, ultimately resulted in significant price increases when you look out and consider the wider picture. After the initial halving in 2012, Bitcoin shot up from $12 to over $1,000 in only a single year. Following the second halving in 2016, the price increased from about $650 to almost $20,000 by the end of 2017. I was present for the third halving in 2020, which paved the way for Bitcoin’s incredible ascent to more than $60,000 by April 2021.

In my own experience, I chose to hang onto my Bitcoin instead of selling it to make quick money following the 2020 halving. This turned out to be a smart move since over the next few months, I saw the price increase significantly. But it’s important to remember that many more variables affect Bitcoin’s price outside its halving, such as institutional adoption, market mood, and international economic circumstances.

Also Read: Cryptocurrency Investment: Proven Strategies for Financial Success and How to Start

Is It Better to Buy Bitcoin Before or After the Halving?

When I initially began investing in Bitcoin, I couldn’t decide whether to buy before or after the halving. Before the event, Mike suggested that I purchase because prices tend to rise as people get ready for the halves. However, being cautious, I chose to observe how the market responded following the halving.

In a way, each tactic has advantages. In anticipation of a potential post-halving surge, investors drove up the price of Bitcoin in the run-up to the 2020 halving. The price increase probably paid off for those who purchased in advance. But there was a short time of stability following the halving when prices steadied and others had a chance to join the market at comparatively reduced costs.

Whether you buy before or after the halving doesn’t matter if you’re in it for the long run, in my opinion. Knowing the general cycles of the Bitcoin market is crucial, as is avoiding rash judgments based on short-term fluctuations in price. My long-term investment plan let me ride out the periods of uncertainty and eventually make sizable gains, although I do remember being nervous following the halving if the price didn’t jump up right away.

When Is the Next Bitcoin Halving?

The current prediction is that the second Bitcoin halving will occur in April 2025. This is an approximate period; the actual date is subject to change based on the block generation time. I’ve started observing market movements and the excitement surrounding Bitcoin more closely as the event draws nearer.

I’m going to go into this again with greater caution, having learned from my mistakes with the 2020 halving. My focus is on gradually acquiring Bitcoin, irrespective of brief price movements, instead of attempting to time the market. Though nothing is guaranteed in the world of investing, I think that the next halving will probably result in another big price increase down the road. Here is a video below to predict the next bitcoin halving price prediction.

Is It Appropriate to Purchase Bitcoin in Halving?

Given that prices have historically tended to rise following halvings, numerous investors have great hopes for them. There is no assurance that Bitcoin will continue the same path. However, previous trends have proceeded slowly over months or years before the next halving. It so relies on the state of the market, your view. It also depends on your risk tolerance whether you invest in Bitcoin before, during, or after the halving.

Securities and Exchange Commission (SEC) just a few months before the event. Exchange-traded funds (ETFs) gained popularity, drawing in investors and speculators who shifted their funds from the previously well-liked Bitcoin ETF Trusts to these new offerings.

The market moved once again a month after the halving, and prices decreased. The ETFs had large withdrawals at the start of May, which were followed by inflows of a comparable magnitude. As the price of bitcoin rose in May, the market became more positive about the Ether ETF.

It appears that all anyone can do is speculate wildly about what the market will do, at least going forward. From my own experience, I’ve discovered that halving doesn’t instantly send prices through the roof. However, it has consistently proven to be a reliable predictor of future price increases. Your investing strategy, risk tolerance, and long-term goals will determine whether you buy Bitcoin before or after the halving.

What Causes Bitcoin to Halve?

Because of the way its software is designed, Bitcoin is halved. It was produced under the assumed pseudonym “Satoshi Nakamoto” by an unidentified individual or group. Though Satoshi hasn’t stated it clearly, many have theorized that the mechanism was initially intended to distribute coins more quickly to encourage users to become part of the network and mine new blocks. According to this argument, block rewards were set to periodically halve because it was anticipated that as the network grew, the worth of every coin received would rise.

Additionally, it is believed that the halving was carried out to introduce deflationary measures into the coin, i.e., a fixed number of new coins earned in every block. Unlike the real-world financial system, where central banks’ overprinting can cause a continual decline in the value of the currency, the stipulated rate of printing new bitcoins and the maximum amount of bitcoins available limit this risk.

The limited number of 20 million coins and other aspects of the Bitcoin design have drawn criticism for encouraging users to save instead of spending money in the expectation that coins will appreciate over time. Due to consumers storing coins only to cash out at critical levels, this may have contributed to previous boom and bust cycles. For similar reasons, some have also drawn comparisons between Bitcoin and a pyramid scheme (Ponzi), claiming that the initial design of the system has unfairly benefited those who took part first.

Conclusion

A halving of Bitcoin reduces the amount of new coins that are issued into circulation by half. One of the main features of Bitcoin’s architecture is its halving, which is essential to its price movements and trading behavior. Thoughts of how rapidly Bitcoin has progressed since I first heard about it in 2015 come to mind as we get closer to the 2026 halving. Its halving process is still one of the most fascinating parts of its economic architecture, even if the digital currency that began as a niche asset has now become a worldwide asset. Knowing why Bitcoin is halving is important for all investors, experienced or novice, as it helps you navigate the constantly uncertain world of cryptocurrencies.

Related Articles

- How to Make Money in Crypto: Expert Tips and Strategies for Success

- Top 10 Crypto Trading Mistakes to Avoid for Beginners (2025 Guide)

- Top 6 Altcoins to Invest In 2025: Watch Out for These Crypto

- Crypto Arbitrage Explained: Best Bots & Platforms to Maximize Profits in 2025

3 comments

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.